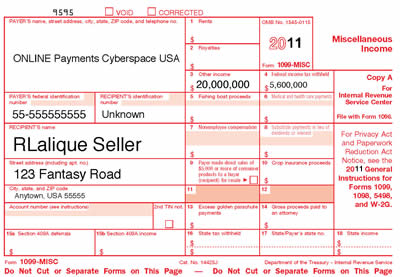

There is a little noticed provision in the Housing and Economic Recovery Act of 2008, an act which we have also seen called the Housing Rescue and Foreclosure Prevention Act of 2008, and which is also known as H.R. (House Resolution) 3221. If they were going with three names, why not Larry, Curly, and Moe? At least we could remember those names! Anyway, this provision will affect many individuals and small businesses that are casual or not so casual sellers of all kinds of items, as well as dealers and retailers. This bill became law on July 30th of this year. Stuck in among its more publicized features is a provision that does not take effect for over two years. But, starting in 2011, the law provides that all processors of credit or debit card charges must report the proceeds which sellers receive to the IRS if the seller has at least 200 transactions that total over $20,000 in a tax year. This would include not just banks that process credit card payments for retailers, but also companies that process online credit card payments such as Paypal, and online store type operations such as Google Check-Out. The effect of this new law will be to give affected sellers (for example an Ebay seller of R.Lalique) a 1099 with a copy to the Internal Revenue Service, showing the proceeds the seller has received during the year. Of course, the vast majority of sellers (sellers of R.Lalique or otherwise) that properly report all their income should have nothing to worry about. You should also know that credit card processors and others affected will need Taxpayer ID’s from sellers. If a seller does not provide a Taxpayer ID, the processor is required to withhold 28% of the proceeds. No, that is not a mis-print; it’s 28%. Of course, would it really bother you if your 2011 1099 from your credit card processor looked like the following?

There is a little noticed provision in the Housing and Economic Recovery Act of 2008, an act which we have also seen called the Housing Rescue and Foreclosure Prevention Act of 2008, and which is also known as H.R. (House Resolution) 3221. If they were going with three names, why not Larry, Curly, and Moe? At least we could remember those names! Anyway, this provision will affect many individuals and small businesses that are casual or not so casual sellers of all kinds of items, as well as dealers and retailers. This bill became law on July 30th of this year. Stuck in among its more publicized features is a provision that does not take effect for over two years. But, starting in 2011, the law provides that all processors of credit or debit card charges must report the proceeds which sellers receive to the IRS if the seller has at least 200 transactions that total over $20,000 in a tax year. This would include not just banks that process credit card payments for retailers, but also companies that process online credit card payments such as Paypal, and online store type operations such as Google Check-Out. The effect of this new law will be to give affected sellers (for example an Ebay seller of R.Lalique) a 1099 with a copy to the Internal Revenue Service, showing the proceeds the seller has received during the year. Of course, the vast majority of sellers (sellers of R.Lalique or otherwise) that properly report all their income should have nothing to worry about. You should also know that credit card processors and others affected will need Taxpayer ID’s from sellers. If a seller does not provide a Taxpayer ID, the processor is required to withhold 28% of the proceeds. No, that is not a mis-print; it’s 28%. Of course, would it really bother you if your 2011 1099 from your credit card processor looked like the following?

So sellers should expect to hear from outfits such as Paypal requesting their Taxpayer ID, assumedly before the law takes effect. And certainly more details will appear as the time for implementation approaches. We have two final notes. First, 700 pages, three names, and no hint of this provision in any of those names :). And second, this is not tax advice. It is a layman’s summary of a small part of a complicated and important law that is certainly incomplete, and maybe even partly incorrect. So, consider this a “heads up” and NOT advice (be it tax, marital, or free).

All Articles on These Topics: Internal Revenue Service - IRS - Taxes, R Lalique and Rene Lalique Sellers